The Santiment analytics agency noted the inflow of new TrueUSD to the exchanges, and the turnover of this stablecoin increased to a record historical value. Against the background of its growth, the market share of another stablecoin, BUSD, continues to decline. The reasons for these two related events are discussed in this article.

The triumph of TrueUSD

Santiment specialists reported that previously unclaimed TrueUSD (TUSD) tokens are moving massively to exchanges. According to their data, as a result, the exchange supply of TUSD has increased by 73% over the last month. This is a record turnover value for this stablecoin since 2021.

The influx of stablecoins to exchanges, as a rule, indicates their demand and the growth of general purchasing power, which is a good sign for the entire crypto market. At the moment, TUSD is ranked 49th by CoinMarketCap, with a market capitalization of $1,117 million.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Explain the growth in popularity of TUSD by the fact that after the scandal with BUSD, Binance started to mint TrueUSD as an alternative. TrueUSD has already become the 5th largest stablecoin in the world, thanks to Binance minting about $130M new TUSD in a week.

As you can see from the chart below, the growth of TUSD’s capitalization has started since the regulator’s attack on Binance in February.

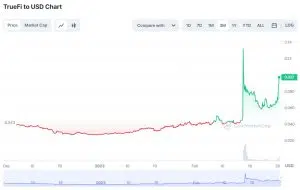

Another indicator of TrueUSD’s popularity is the rise in the price of the $TRU token, which began to increase in price in sync with the entry of Binance. $TRU (TrustToken, aka Archblock) is the Ethereum token that powers TrueFi, a decentralized financial protocol, one of whose products is stablecoin TrueUSD. According to other sources, TrueUSD was recently bought out by the Techteryx conglomerate and is now an independent product, but there is no confirmation of that deal on its official website yet.

Investing in $TRU is an interesting way to capitalize on the popularity of TUSD (not commercial advice), and as you can already see from the chart below, the market is starting to do just that. $TRU has risen in value over the past two weeks by more than 120%. It remains to be seen how sustainable this trend will be, but for now, TUSD is pulling its parent project, TrueFi.

BUSD share reduction continues

The market supply of BUSD from the largest cryptocurrency exchange Binance has decreased by $5 billion following demands by U.S. regulators to stop issuing the asset in early February. Binance CEO Changpeng Zhao has since said that following the regulatory attack, the exchange is considering a complete termination of relationships with all U.S. business partners.

According to CoinMarketCap, BUSD’s market capitalization has declined 32% from $16.1 billion to $10.97 billion since Feb. 10. In early February, the New York State Department of Financial Services (NYDFS) required Paxos Trust to stop issuing new BUSD due to legal violations.

Within a day after the announcement, the outflow of funds from Binance amounted to $916 million. Subsequently, the issue of stablecoin BUSD was completely stopped on February 21. The process of investors’ withdrawal from BUSD has not stopped so far; for example, during the last week its capitalization fell by minus $2.27 billion.

In addition to BUSD’s problems with Binance, an additional hit to the capitalization was caused by Coinbase, the largest American cryptocurrency exchange, which yesterday decided to suspend BUSD trading. Stablecoin will soon be removed from Coinbase.com, Coinbase Pro, Coinbase Exchange, and Coinbase Prime.

“Coinbase will stop Binance USD (BUSD) trading on March 13, 2023,” the company said in an official statement.

At the moment, it is clear that there is a gradual replacement of BUSD’S market share at the expense of competitors. At the same time, not only the share of TUSD is increasing, but also the shares of the leaders in this market — USDT and USDC.

#Binance minting TUSD and burning BUSD$TUSD minted supply is more than $FRAX

Will $TRU reach the same valuation as $FXS?

Will TUSD replace $BUSD? pic.twitter.com/ZT8fhi1ME0

— Bx Research (@bxresearch) February 28, 2023