One week has passed since the U.S. SEC attacked Kraken over its stacking service. We found other major players in the market and learned their position on staking. It seems that the market has gradually calmed down and is taking a wait-and-see approach; at least other staking services in the U.S. continue their work.

What is the problem?

The recent attack by the U.S. SEC on Kraken’s staking services raised counter-questions from the market. The meaning of the accusation of the regulator is clear in general, but there is a dangerous precedent — what will happen to all the other services of a similar type? So far, these services continue to work, and Ethereum itself provides staking directly, which can also potentially raise questions.

This market follows the same pattern — all major staking providers like Kraken accept ETH from ordinary users, then bundle them into portions of 32 ETH. Ethereum’s staking terms only allow large stakes of at least 32 ETH ($500,000), so ordinary users cannot participate in staking directly and have to look for providers that accumulate their users’ funds into portions.

Once they receive their income from such staking, the staking provider then divides all revenue among their users in the proportion they have contributed. The SEC considers this whole scheme to be an offer to the market of a secure product with a guaranteed income.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

The big players

A week after the Kraken scandal, we decided to look at the current stats of the biggest staking providers to see who is at risk of becoming the next victim of the SEC.

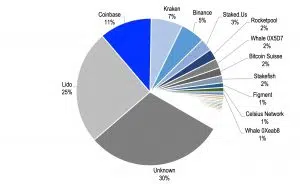

Based on this data, we can see that the two largest centralized staking operators right now are the LIDO provider and the Coinbase exchange. Interestingly, the SEC didn’t decide to attack the biggest players in the market, but started with Kraken, which is now the third largest in that market.

LIDO’s reaction

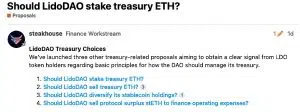

The Lido community, the largest independent staking provider, is organized differently from Coinbase and Kraken: it has no legal entity and exists as a DAO — a self-governing autonomous organization based on smart contracts. In such a decentralized network organization, the community decides all issues through voting.

Regardless of the result of this vote, unstaking decisions will take effect after the spring Shanghai upgrade of Ethereum, when the network will have technically unblocked withdrawals.

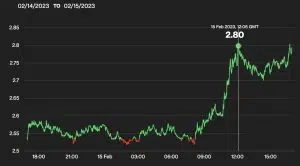

LDO, a governance token used for voting at Lido, rose 10% in a day after the company submitted a proposal Tuesday on whether it should sell or put $30 million in stake. LDO has gained 30% in a month and witnessed a rally late last week after the news about Kraken.

DAO Lido currently owns 20 304 ETH; DAO’s total assets amount to $ 350 million. The funds are held in the Aragon project contract. The TVL of Lido is currently $8.13 billion, according to on-chain metrics platform DeFiLlama.

📈 Lido Analytics: Feb 06 – 13, 2023

TLDR:

– Lido TVL is down -6.66%, following a -7.22% fall in the price of ETH.

– Lido led in new stake on Ethereum, with a 27% share in weekly deposits.

– New @AaveAave V3 wstETH: 34,726 (+34.87%).

– Lido on Polygon reaches 2% market share. pic.twitter.com/iWA9YccM6e— Lido (@LidoFinance) February 13, 2023

Coinbase’s reaction

Unlike the decentralized LIDO organization, Coinbase is the most likely and easiest target for the next US SEC attack. The company’s stock has fallen more than 30% since last week due to investor fears, but the market has gradually calmed down in recent days and the share price is up 10%.

Coinbase considers the authorities’ decision on Kraken to be controversial and has outlined their current position in great detail.

- First, the exchange released a detailed blog post explaining that Coinbase’s staking services are not securities. And here’s why: The exchange is trying to distance itself from the Kraken case (without commenting on it in any way), while disputing possible similar claims against it.

“Staking is not a security under the US Securities Act, nor under the Howey test, which the SEC uses to determine whether an investment contract is a security. The Howey test comes from a 1946 Supreme Court case – and there is a separate discussion to be had about whether that test makes sense for modern assets like crypto. Regardless, staking fails to meet the four elements of the Howey test.”

- Second, an interesting thread from Brian Armstrong on Twitter, co-founder & CEO of Coinbase, who explains in detail why his company is not affected by this threat.

“We’re hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that’s not the case, as I believe it would be a terrible path for the U.S. if that was allowed to happen.

Regulation by enforcement doesn’t work. It encourages companies to operate offshore, which is what happened with FTX.”

- Third, Brian then refers to a very thorough legal breakdown of Ethereum’s New ‘Staking’ Model Does Not Make ETH A Security (we recommend this great document to anyone who wants to understand the problem in depth).

So Coinbase currently believes that its staking does not violate US law (without commenting on the Kraken case) and has not yet restricted its services in any way. Lido DAO’s position should be known in the coming weeks.

@secgov has made a number of misinformed assertions about staking over the past few days, and asked a number of misguided questions. Let's set the record straight point by point–there's a lot of FUD to cover. https://t.co/2CBT8mdKke

— paulgrewal.eth (@iampaulgrewal) February 10, 2023