Contents

Blockchain Solana managed to survive the crypto winter with a good performance. According to platform founders Anatoly Yakovenko and Raj Gokal, the ecosystem is showing signs of active recovery even in an unstable market. And they have many plans for 2023. Let’s take a closer look at what Solana has achieved, where blockchain is headed, and what’s in store for the SOL price.

To survive and grow up

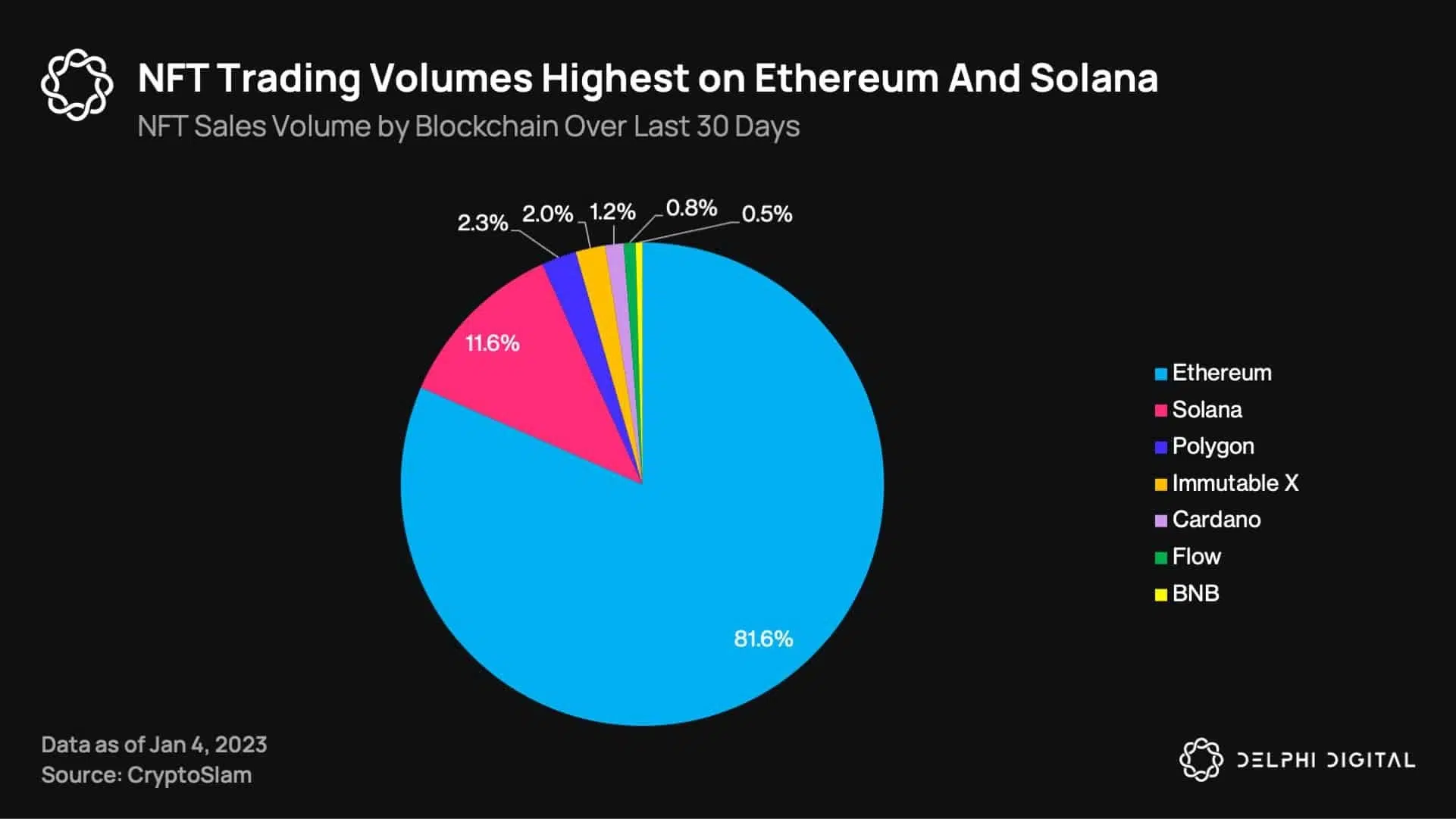

Solana ranks second in terms of NFT trading volume on blockchain platforms with a share of 11.6% (over the past 30 days), according to Delphi Digital. This blockchain is second only to Ethereum, with the majority share of total NFT trading volume at 81.6%.

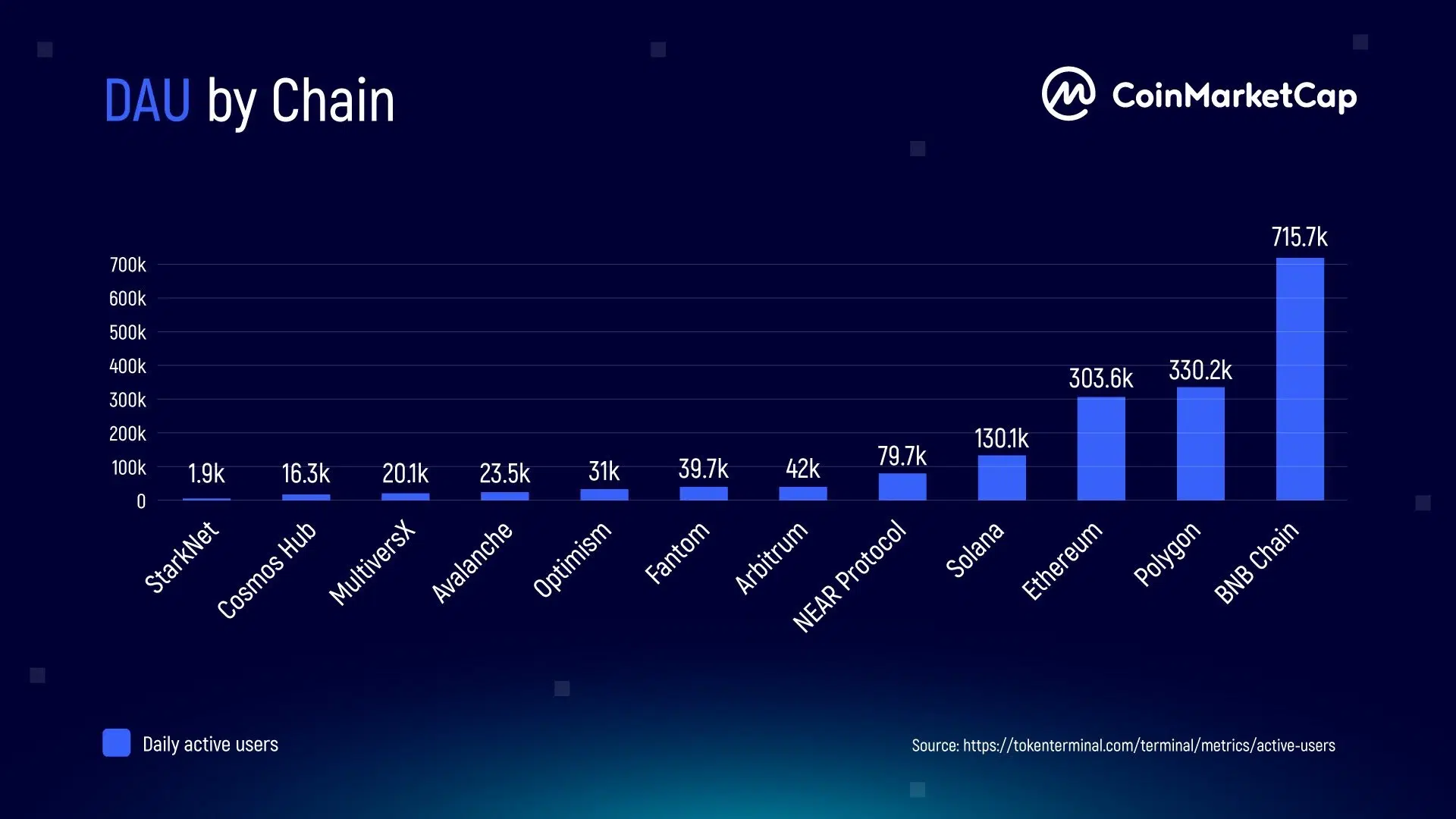

According to CoinMarketCap, Solana was among the top 5 chains that continue to attract the most daily active users in cryptocurrency.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

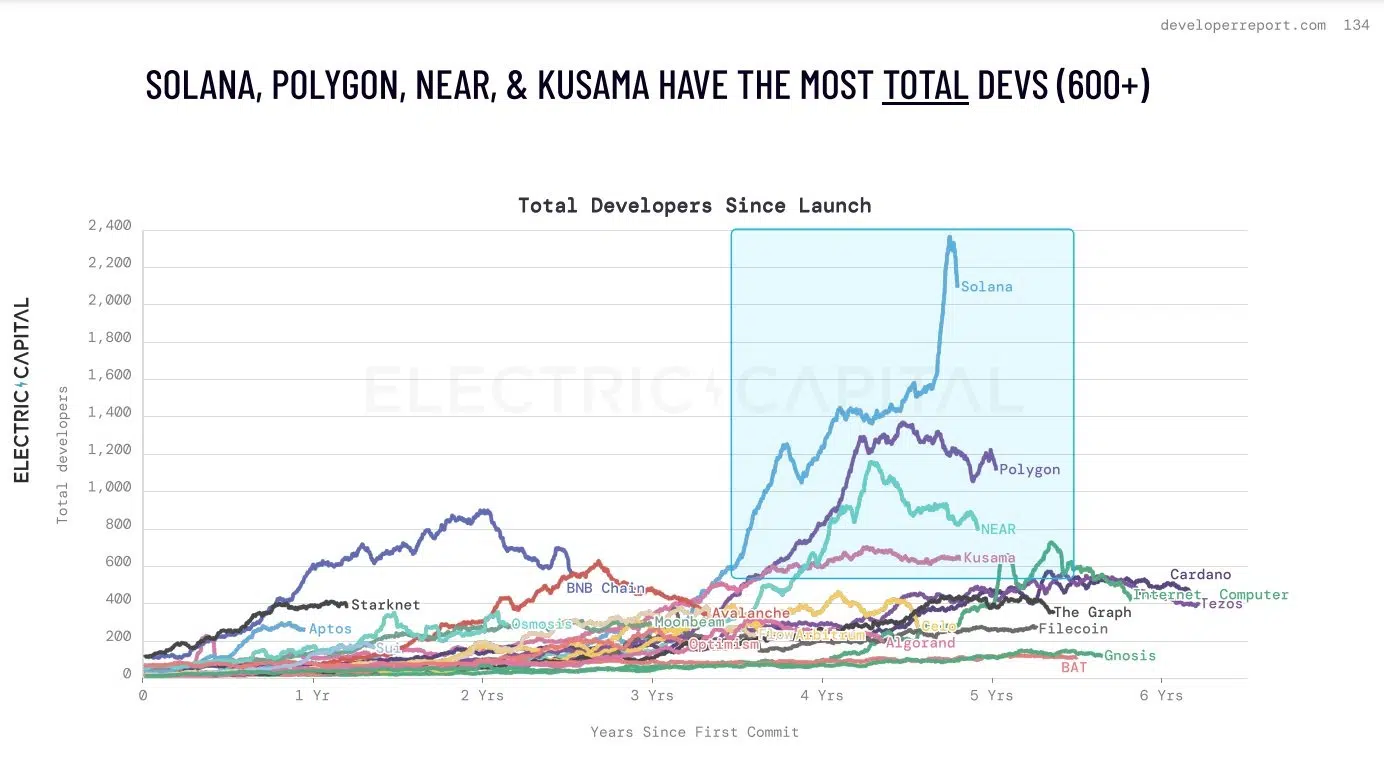

According to a report from Electric Capital, the number of developers at Solana is up 83% as of December 2022 (up from a year earlier). The blockchain now has more than 2,000 active developers. Solana is second only to Ethereum in that number.

Developers are the core of the blockchain project. They are the ones who create the applications that attract people to the blockchain. This usually attracts even more developers, and as a consequence, more attention and people, to the project. And this increases the token’s price, which benefits not only the owners of the blockchain but also investors. Therefore, developer activity on the network is one of the metrics that potential investors pay attention to.

The blockchain founders noted that despite the market decline in 2022:

- The Solana network saw a massive increase in the number of validators. Over 2,000 nodes are running the blockchain, making Solana one of the world’s most decentralized blockchains as measured by the Nakamoto coefficient (The Nakamoto coefficient measures decentralization and represents the minimum number of nodes required to disrupt a blockchain network. A high Nakamoto coefficient means that the blockchain is more decentralized.).

- A series of new upgrades have stabilized and strengthened the Solana network. It was able to withstand the load caused by the popularity of the Bonk Inu token (BONK).

- A second validator client created by a third party, Firedancer — which can process 0.6 million transactions per second in a test environment— will make the risk of network outages much smaller and could help move the network out of beta.

By the way, the Solana Mobile Project didn’t disappear. In January of this year, Solana Labs began accepting pre-orders for the Web3-oriented Saga smartphone from users in 33 countries. To be placed on the waiting list, a $100 deposit is required, which can be refunded in the event of failure. The final price of the Android-based smartphone is $1,000.

Deliveries are promised in early 2023. The first wave includes the U.S., Canada, EU, UK, Switzerland, Australia, and New Zealand. The team promised to consider other countries in the future. Users on the list will also be eligible for the NFT Saga Pass and some sort of “ticket” to influence the development of the Solana Mobile Stack platform.

Saga will ship to 33 countries at launch.

US, Canada, UK, EU, Switzerland, Australia and New Zealand.

If you see your flag, go pre-order 🤝

🇺🇸🇨🇦🇬🇧🇦🇹🇧🇪🇧🇬

🇭🇷🇨🇾🇨🇿🇩🇰🇪🇪🇫🇮

🇫🇷🇩🇪🇬🇷🇭🇺🇮🇪🇮🇹

🇱🇻🇱🇹🇱🇺🇲🇹🇳🇱🇵🇱

🇵🇹🇷🇴🇸🇰🇸🇮🇪🇸🇸🇪

🇨🇭🇦🇺🇳🇿— Solana Mobile (@solanamobile) January 19, 2023

The price of SOL was also raised by rumors that tech giant Google had secretly bought a large amount of Solana cryptocurrency and that the companies had agreed to cooperate. However, there has been no official confirmation (nor denial).

Solana’s hard times are over?

In 2022, Solana, like many others, suffered from the collapse of the FTC exchange. The network also had a series of failures, which affected the network’s ability to process transactions.

Also in late 2022, top NFT collections, DeGods and y00ts, left Solana for other blockchain platforms such as Ethereum and Polygon.

Solana’s security credibility was also undermined by two major incidents. The $312 million Wormhole Bridge hack (then 120,000 wETH tokens were removed from the platform and distributed between the hacker’s Solana and ETH wallets). Also, $8 million in SOL was stolen from several Solana-based hot wallets as a result of the large hack.

This caused distrust among a number of investors. Many started getting rid of the native blockchain token, SOL.

Since early 2022, when tokens were worth $136, the price has fallen to $9-$10. However, after a series of good news and innovations, native Solana coins began 2023 with a rise to $24-25. And chances are, this is just the beginning of a return to past greatness.

2023: a bitter pill (or even two)

A Solana-based decentralized finance (DeFi) borrowing and lending platform called “Everlend” announced it was shutting down due to a lack of liquidity in the cryptocurrency market, and asked users to withdraw their funds.

A little earlier, Solana Friktion announced its shutdown, citing a market that was too tight for DeFi projects to grow. The platform switched its lucrative cryptocurrency products under the Volt brand to “withdrawal only” mode.

Despite these unpleasant events, so far there has been no noticeable negative impact on the SOL’s price behavior.

Short conclusion

The network’s native token has grown more than 15% in the last 14 days. The future fate of SOL will be determined by market events and whether the developers can regain the users’ and investors’ trust in their blockchain.

You have not selected any currency to display