On November 8, the crypto world was shaken by the news of the takeover of the third-largest exchange FTX by Binance. Of course, regulators can still block the deal. If the agreement to buy the competitor goes through, Binance will have more than 80% of the stake. And that would attract regulators, according to the Bernstein Research report. However, many consider it one of the darkest events in crypto history.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

Against this backdrop, bitcoin fell to its lowest level since 2020, down to $17,000. Ether was down to $1,228. The native token FTX (FTT) plummeted 77% to $2.56 and the Binance coin (BNB) dropped in value to $300.7. And prices continue to fall, including on lesser-known tokens.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Updating this: total 1% bid depth is less than $300k right now. Was improving before the deal was announced but disappeared after. FTX hit a low of under $8k a few minutes ago; Binance dipped below $6k at 7:40pm UTC but has recovered to about $250k. pic.twitter.com/40GRjj7bS7

— Riyad Carey (@riyad_carey) November 9, 2022

Why was the FTX sold?

Initially, there were rumors that FTX and corporate brother Alameda Research were facing a liquidity crisis. There were concerns that Alameda Research’s balance sheet was overly dependent on illiquid tokens, including FTT.

FTX over the last 18 months:

July ’21: Raises $900M at $18B

Oct ’21: Raises $420.69M at $25B

Jan ’22: Raises $400M at $32B

Jul ’22: Bails out BlockFi for $250M

Sep ’22: Buys Voyager for $1.4B

Nov ’22: Acquired by Binance— Tanay Jaipuria (@tanayj) November 8, 2022

CoinDesk noticed on Nov. 2 that almost all the assets of the trading firm Alameda are FTTs, which the crypto publication’s analysts called non-liquid.

Binance’s CEO then ratcheted up the pressure by saying he planned to sell his stock of FTT tokens. The announcement came a day after network data showed that Binance had already transferred its FTTs to the tune of $584 million.

Fearing a repeat of the Terra LUNA collapse, the smaller players started getting rid of their FTX crypto exchange coins.

FTX turned to Binance for help, and the parties signed a letter of intent to acquire FTX to help deal with the liquidity crisis.

1) Hey all: I have a few announcements to make.

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

— SBF (@SBF_FTX) November 8, 2022

Traders are shocked

Imagine McDonald’s makes its own money, let’s call them clown-bucks, keeps most of it, and sells some to the market.

McDonald’s then uses their remaining clown-bucks as collateral for actual loans.

And then people remember clown-bucks aren’t real.

— Lyn Alden (@LynAldenContact) November 8, 2022

If you still have FTX funds, they’re gone

Don’t mean to be the bearer of bad news here, but if it isn’t clear already, if you still have funds on FTX, they’re gone. You’re an unsecured creditor.

The probable outcome is Chapter 11 & a class action lawsuit that draws out for years, where you get $0.10-$0.30 on the dollar.

— Dylan LeClair 🟠 (@DylanLeClair_) November 8, 2022

A huge loss

The past 24 hours have been extremely difficult.

I took a huge loss, and an exchange I trusted for years is at the center of one of the largest bank runs we’ve witnessed in crypto.

I know I’m not the only impacted by this, & my heart goes out to others in a similar situation.

— K A L E O (@CryptoKaleo) November 8, 2022

Sad and ironic

A lot of people in Singapore held funds in FTX because Binance is banned here.

Sad and ironic.

— Alex Svanevik 🐧 (@ASvanevik) November 9, 2022

Every day I read about crypto, I understand it less and less

Every day I read about crypto, I understand it less and less. FTX was in talks two months ago to raise 1bn equity at a 32bn valuation. Binance threatens to dump 500mm FTX tokens and the whole thing just collapses? Explain it to me like I’m a 65 year old.

— boaz weinstein (@boazweinstein) November 8, 2022

FTX wasn’t the first, and certainly isn’t the last

FTX wasn’t the first, and certainly isn’t the last.

When Binance introduces proof-of-reserves, this will set the new industry standard for transparency.

We’re about to see who’s swimming naked when the tide goes out.

— Miles Deutscher (@milesdeutscher) November 9, 2022

This is one of the darkest days in crypto history

My thoughts go out to anyone with funds stuck in FTX.

This is one of the darkest days in crypto history.

Disappointed that greed continuously degrades what we’re trying to build.

— Miles Deutscher (@milesdeutscher) November 9, 2022

Three of the worst events in crypto happened this year

The worst events in Crypto history:

• Mt. Gox Hack (’14)

• The Dao Hack (’16)

• Terra Luna Collapse (’22)

• FTX sells to Binance (’22)

• 3AC Collapse (’22)3 of the worst events in in Crypto happened this year.

If you survived this year, you’ve earned your stripes.

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) November 8, 2022

FTX has no crypto

Uber has no cars

Airbnb has no real estate

FTX has no cryptoThis is the new economy.

— Ellie Frost ❄️ (@EllieFrost) November 8, 2022

Now crypto exchanges are planning to implement Proof-of-Reserve

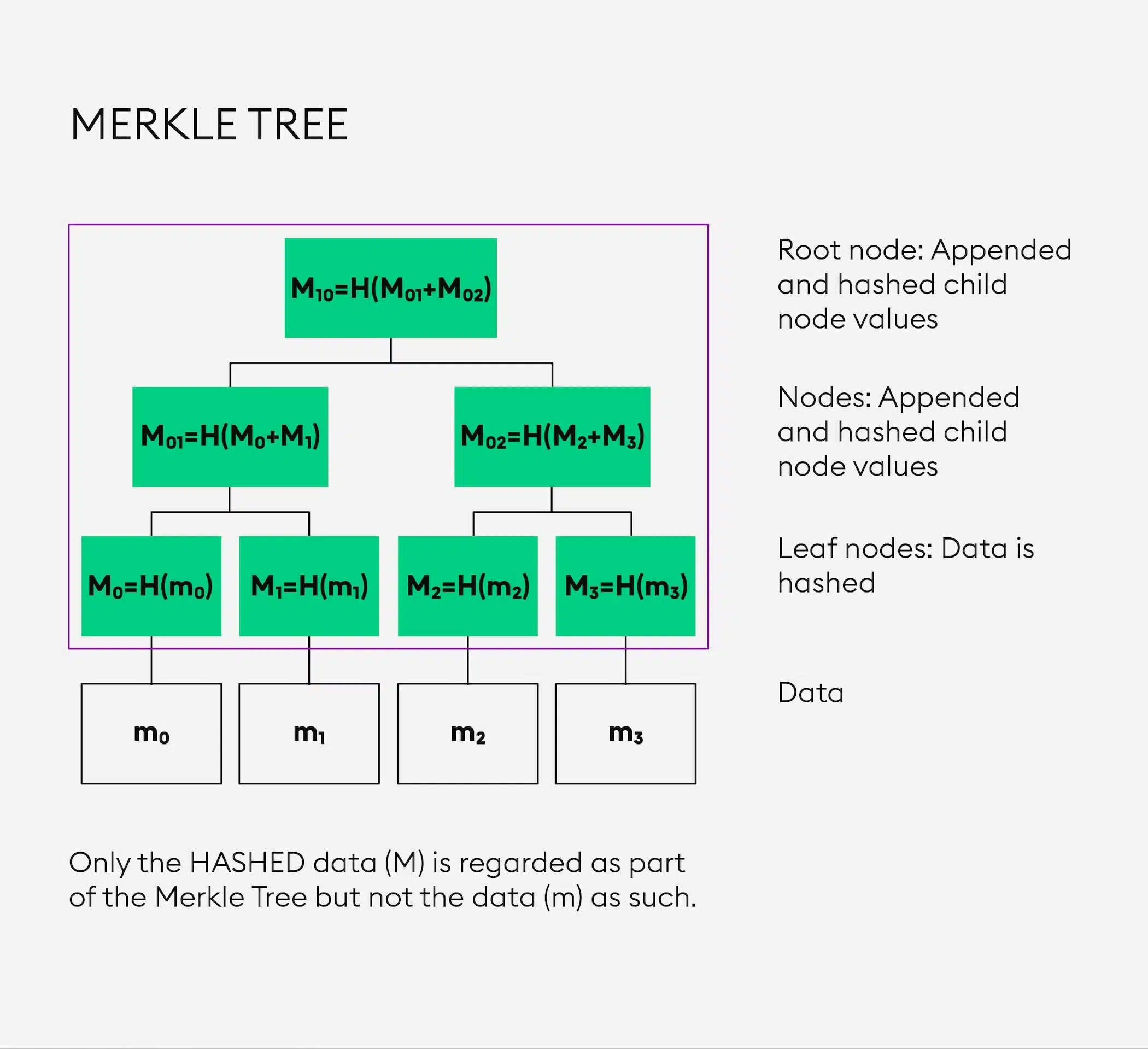

The story with FTX and its tokens was very educational. The Binance CEO wrote that you cannot use your own token for collateral, and you cannot borrow funds if you own a cryptocurrency business. Therefore, Changpeng Zhao (CZ) believes that cryptocurrency exchanges should use Merkle Tree-based Proof-of-Reserve, for full transparency of their collateral.

The initiative has already been supported by Kucoin, Huobi, OKX, and Gate.

All crypto exchanges should do merkle-tree proof-of-reserves.

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.— CZ 🔶 Binance (@cz_binance) November 8, 2022

How can I make money on this?

Everyone who enters this space should know that this is a blood sport, every man for himself. Your losses are another one’s profit, don’t forget that. And seriously, what should people who trusted FTX do now? Always protect your capital: withdraw it from exchanges, don’t play with leverage, and be skeptical.

Now, some traders and investors rely more on fiat currency (regular money) and stablecoins, whose value depends on companies’ real stocks.

After the sad story with FTX, the cryptocurrency market faces its lowest level in nearly two years. This year was the turn of loud crashes. Therefore, traders are unlikely to calm down soon. Against the backdrop of looming rate hikes and a worsening global economy, bearish sentiment is only increasing, Bitfinex market analysts wrote in a note shared with The Independent.

BTC has lost about 63% of its value since the beginning of the year, Ethereum 68%.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

It may seem attractive to start buying the dip. But experienced crypto investors always remember the rule of thumb that accurately describes the text: “Never try to catch a falling knife.”

Skilled investors, however, have a chance to make a quick buck by trading on increased market volatility. However, rapid changes in the crypto market are unlikely to be within the reach of inexperienced private investors.

Judging by the way the market looks, investors should be quick to realize a short sale. In other words, sell assets borrowed.

However, the cryptocurrency market is so unpredictable that it is impossible to predict its behavior in the long term. But we will keep you informed and promptly inform you of the changing sentiment.