Grayscale’s Ethereum, Litecoin and Bitcoin Cash Trusts are at sharp discounts as concerns surround the Digital Currency Group’s liquidity.

The Grayscale Ethereum Trust (ETHE) shares have dropped 93% from their all-time high in June 2019 while trading at close to a 60% discount to the value of its assets (ATH).

The ongoing decline has a number of causes, but in recent weeks there has been an increase in concerns that Grayscale assets may be impacted by the parent business Digital Currency Group’s debt of over $1.675 billion to the troubled cryptocurrency lender Genesis.

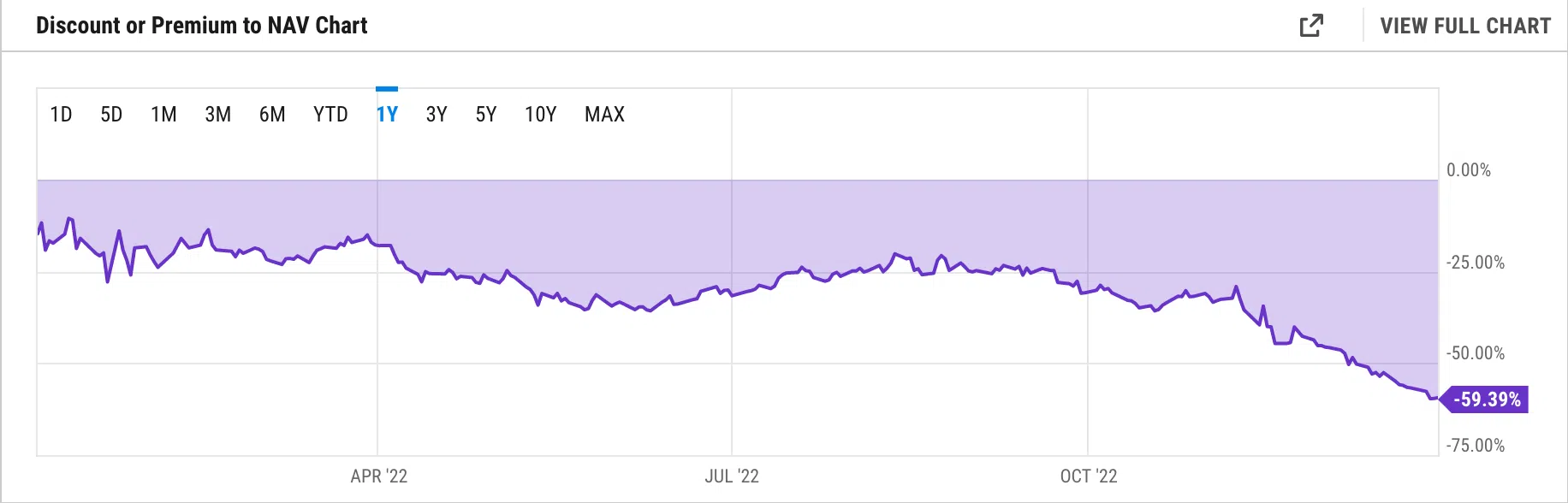

YCharts data shows a 59.39% discount at the time of writing, a level the trust has traded at since at least December 2022.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Crypto Twitter influencer “db” tweeted an image yesterday (Jan 3) depicting the entire collection of Grayscale crypto-based trusts with statistics showing their respective premium.

Kicked when down

Every Grayscale trust and their respective premium % pic.twitter.com/TYQf5FmeXt

— db (@tier10k) January 3, 2023

It revealed that the majority of Grayscale’s trust funds are selling at a discount, with the Ethereum Classic Trust being the most severely affected and presently trading at a 77% discount.

The Grayscale Bitcoin Trust (GBTC) is trading at a 45% discount.

Just two Grayscale Trusts—the Chainlink Trust at 24% and the Filecoin Trust at 108%—are now selling at a premium.

According to Grayscale’s official website, the Grayscale Ethereum Trust (ETHE) pool presently has assets worth $3.7 billion, which were gathered from 31 million shares.

The Ether (ETH) now at $1,251 per share is around 0.0097 ETH, which is worth $11.77 USD, while the market price per share is $4.77 USD.

A game of he said… he said…

Grayscale’s parent firm, DCG, came under fire once more this week when Gemini co-founder Cameron Winklevoss criticized DCG CEO Barry Silbert in an open letter posted on Twitter.

Winkelvoss claimed Genesis (DCG’s company) owes Gemini $900 million in funds lent to it as part of Gemini’s Earn product that the two companies ran in partnership.

https://twitter.com/BarrySilbert/status/1609926715454771200?ref_src=twsrc%5Etfw

Digital assets research and analysis company Arcane Research suggested in a January 3 newsletter that the significant debt DCG and Genesis purportedly owe to Gemini could see DCG initiate a Reg M distribution, which would allow holders of GBTC and ETHE positions to redeem them for the underlying assets at a 1:1 ratio.

GBTC and ETHE holders could redeem their positions for the underlying assets at a 1:1 ratio if DCG initiates a Reg M distribution, according to the Arcane Research report.

This is because DCG and Genesis are allegedly owed a sizable amount of money by Gemini.

Bad news for crypto markets but good for ETHE shares.

“A Reg M would cause a massive arbitrage strategy of selling crypto spot versus buying GrayscaleTrust shares. If this scenario plays out, crypto markets could face further downside.” Arcane Research.

Winklevoss took to Twitter on the alleged DCG liquidity issues, previously tweeting an update in December 2022 that global investment bank Houlihan Lokey had presented a plan on behalf of the Creditor Committee to provide a pathway for the recovery of assets.