The fact that entering crypto is not that easy, I think many people know. If not — read this article, and you will understand that just buying cheaper and selling more expensive will not work. You have to use certain crypto strategies. There are several types, and before you choose one or the other, you have to do your research. And this requires analytical tools (and brains). Say a big thank you for the detailed description to Xtrapsp2 from Reddit.

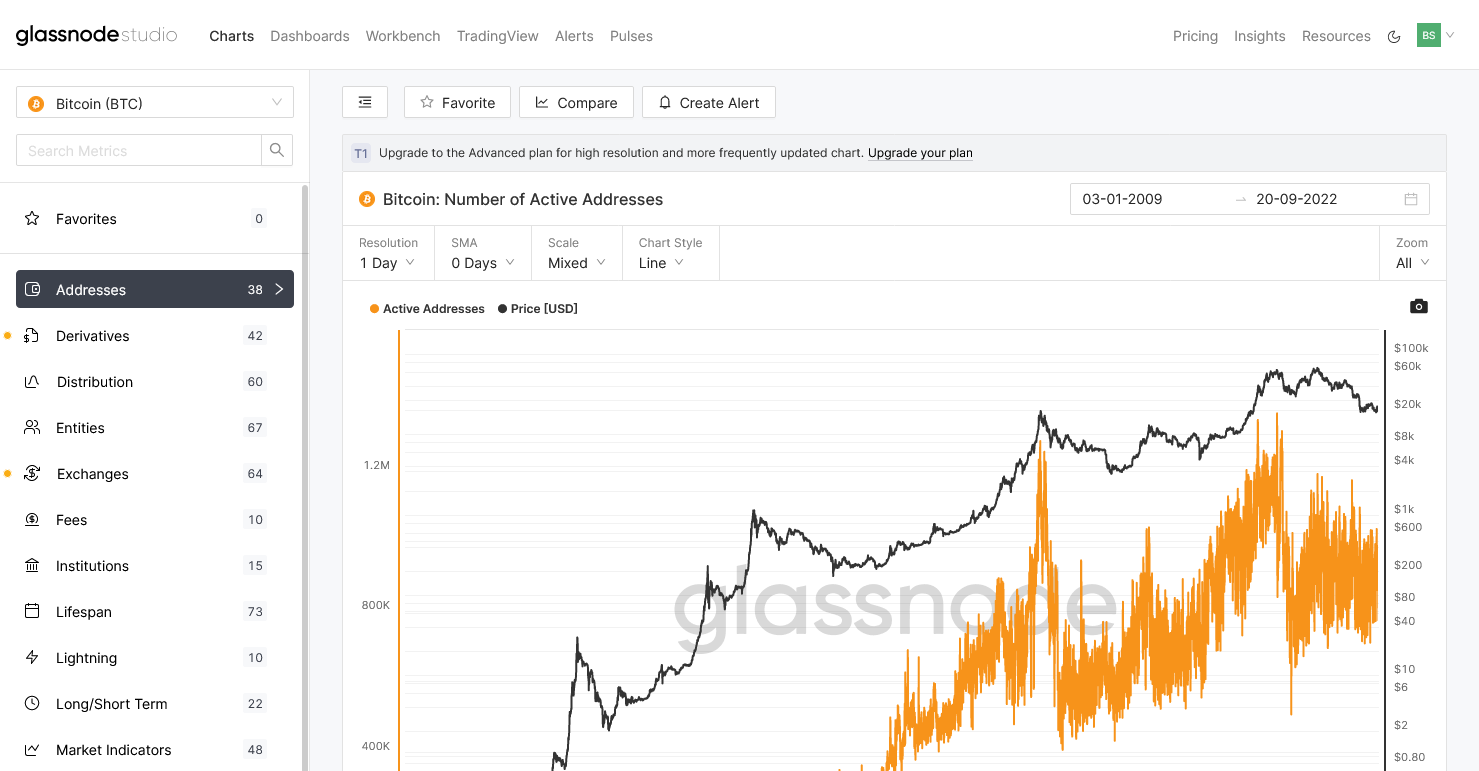

Glassnode

It’s great for assessing the current mood of cryptocurrencies by providing raw data. If you like to evaluate all the metrics and charts yourself (which many traders often want to do), Glassnode has a panel with even more detailed metrics (but for a fee). For beginners who might find it difficult, there is a free academy to teach this useful art.

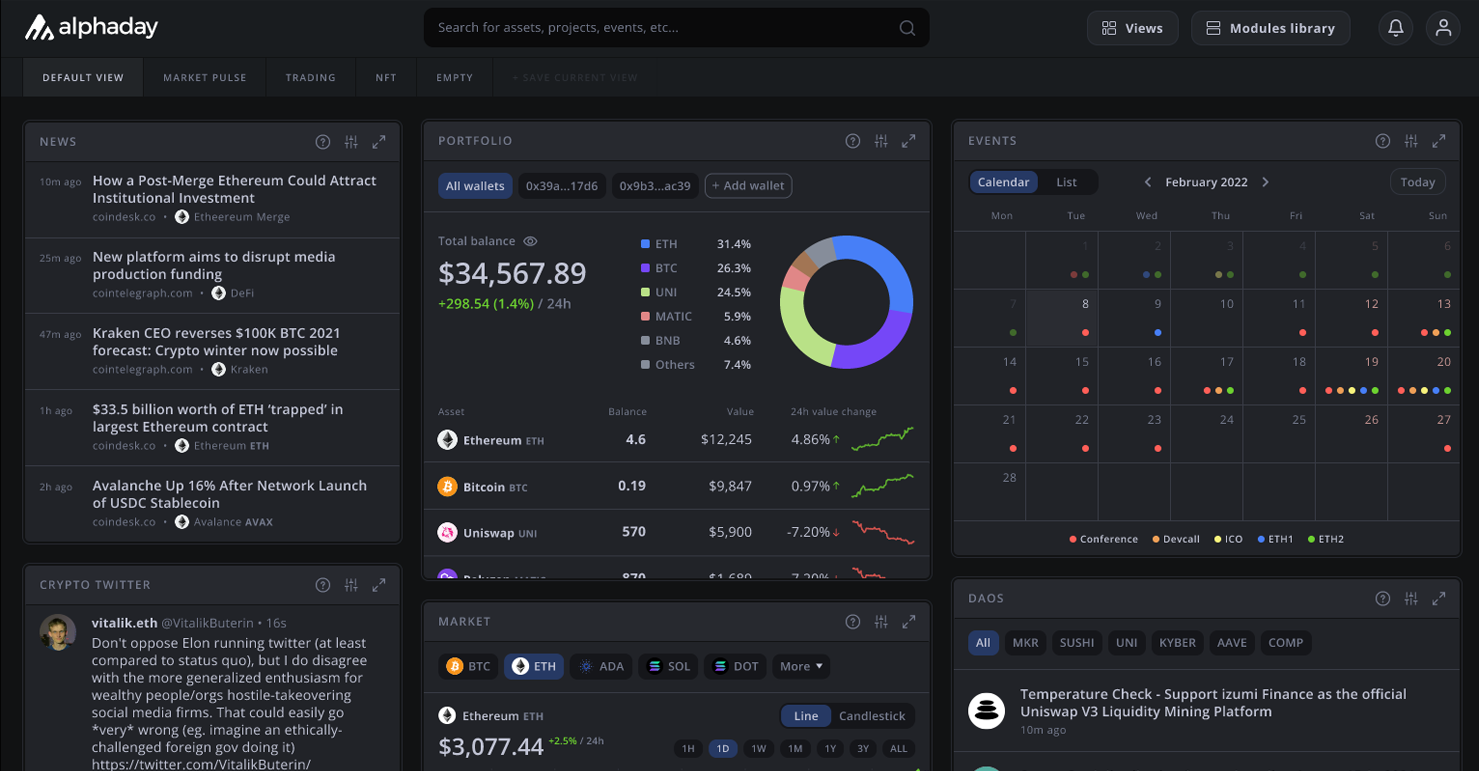

Alphaday

A fairly new (and so far free) tool that allows you to track cryptocurrency news and market information. The dashboard is customizable and will enable you to drag and drop different items and connect multiple wallets to keep track of your tokens and portfolio as a whole. The platform also has a handy calendar of cryptocurrency events.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

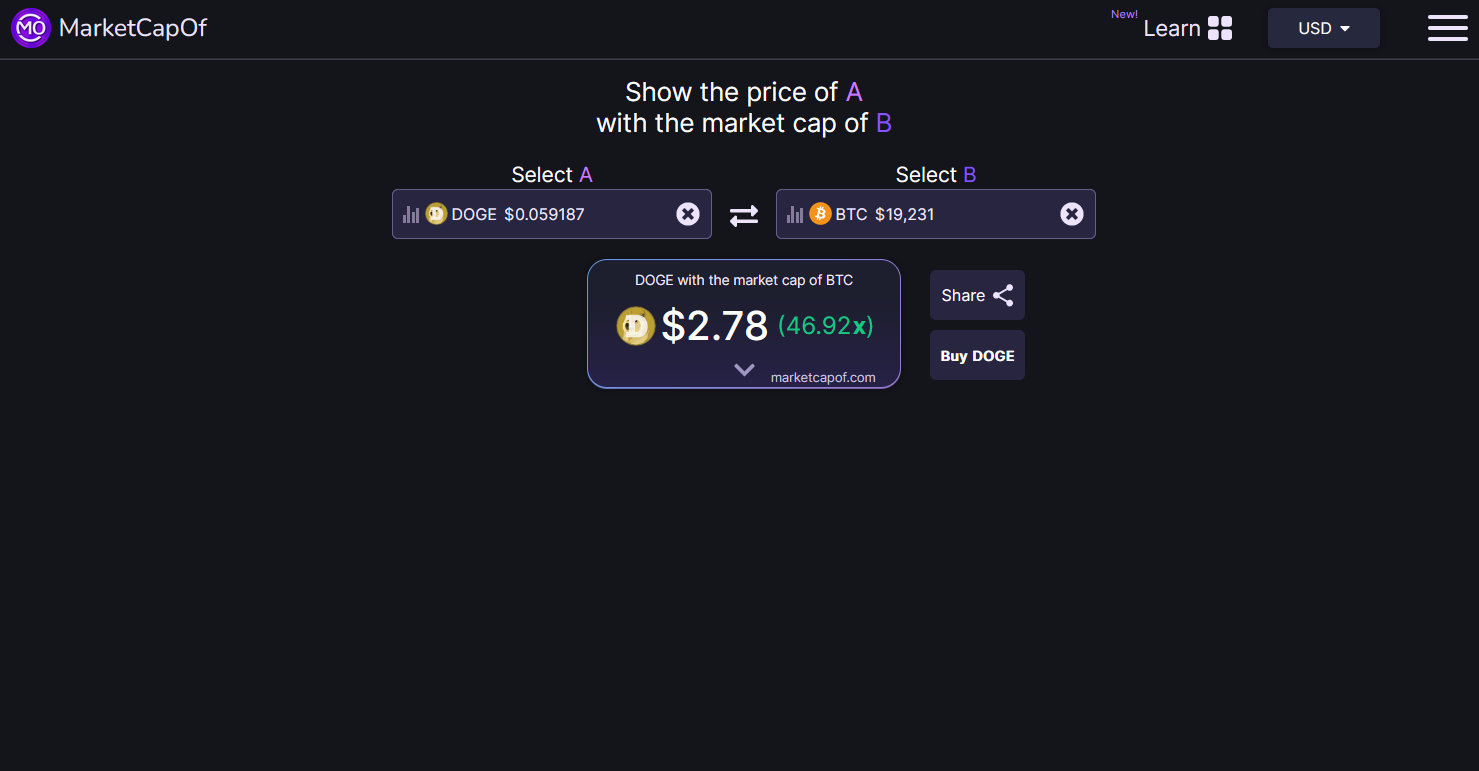

MarketCapOf

The most useful thing about this app is that it allows you to see how altcoins would behave if they had the market value of another token. For example, if Doge had a market value of BTC, it would be worth $2.78 (image above).

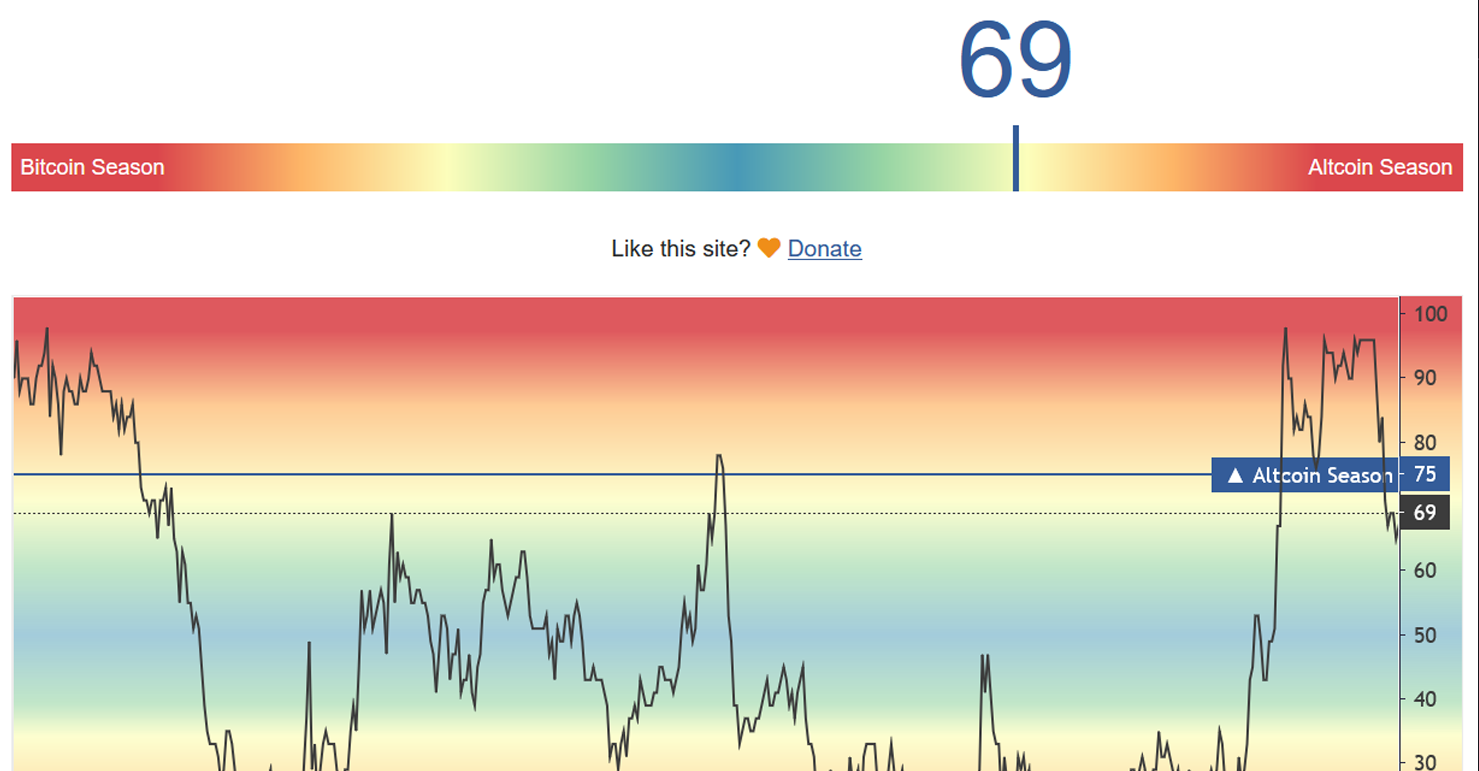

Altcoin Season Index

This tool allows you to work based on conceptual data. This is when bitcoins are rising, altcoins are falling, and vice versa. And to see the current state of the market in a more understandable format. When the altcoin season tends to end or is in a downtrend, many traders transfer their funds into bitcoin in the hope that it will rise along with the rate before the “bitcoin season” or simply keep their funds safe during a bear market.

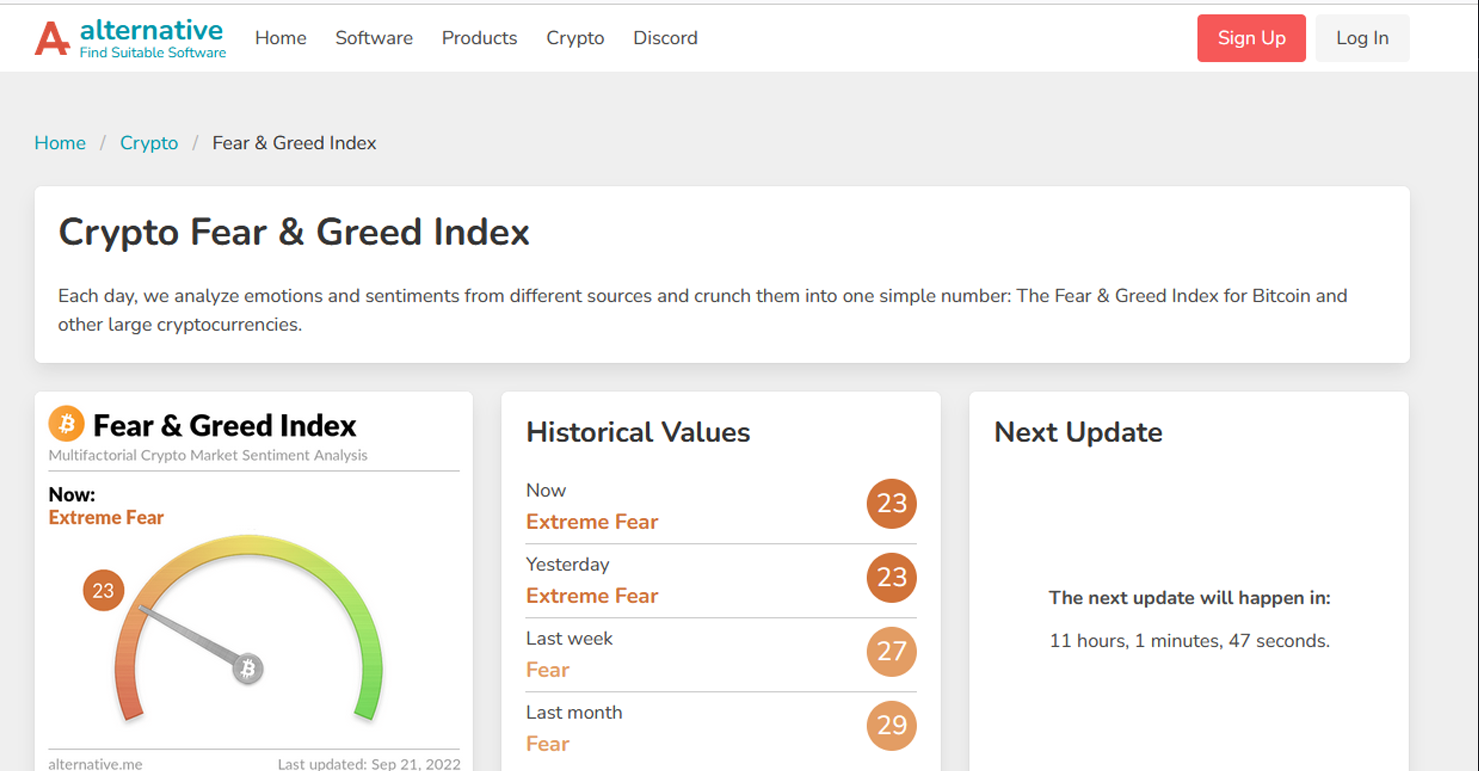

Crypto Fear & Greed Index

This tool collects data from various sources and uses a proprietary algorithm to determine market sentiment. Therefore, it helps you better understand when to buy and sell different tokens, especially if you are a day or swing trader. Various useful metrics are available: volatility, market momentum/volume, social media, dominance, and trends.

Koinly

This software allows you to connect various exchanges and wallets using an API. It will enable you to calculate possible taxes related to digital assets.

So it’s up to you to do your analysis or listen to different influencers or YouTubers before you start working with crypto. But remember, other people are not responsible for what they say. Oh, and one more thing. Try not to make these mistakes if you’re a newbie.