A popular user from Twitter @1MarkMoss has told about his theory of why the crypto market won’t see another bull run (except for Bitcoin, which is a special case). Along with him, we try to understand what’s going on in the crypto market and how unique this crypto winter is.

A short summary

The speech of Mark Moss with his analysis of the crypto market gathered a huge number of comments (here is this video). Many users (from those who hate video content) asked to repeat the theory in a thesis, so he wrote an interesting thread on Twitter.

He comes to two conclusions, a bad and a good one:

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

- The crypto market (talking mostly about altcoins) won’t see another bull run;

- with the exception of Bitcoin, which represents a special case.

Now for more details: what does this mean?

For those who are interested, let’s briefly review the author’s reasoning chain. Mark Moss writes:

you need to understand WHY the Crypto markets have pumped so hard to understand why there won’t be another one crypto gave companies a way to create $$ from thin air, which is what stocks are, allowing people to exchange money for a secured interest in the new company

Venture Capital LOVED being able to invest early, receive tokens at massive discount, then dump on retail Chamath & Sachs are laughing about the “discount” they received on billions of Solana, then dumped on retail Example: They buy at $0.09 and sell for $0.25 over and over

court cases set precedence, the founder of LBRY said under SEC v LBRY “almost every crypto including ETH and DOGE are securities” Now its (sic) up to the SEC to decide the fate of these projects, and after the FTX blow up, they are under extreme fire and pressure now to act

Thus, almost all altcoins have the attributes of security assets, most of them also have offices with a legal entity, a CEO position, and other attributes of a commercial enterprise. The beginning of regulation for these kinds of assets will be the beginning of their end (not in the sense of destruction, but in the sense of the impossibility of pump&dump schemes that have made crypto synonymous with easy money). The beginning of regulation, accelerated by the notorious collapse of FTX, ends the era of fast money in crypto.

But what about the good news? What will happen to Bitcoin? Why isn’t it affected?

Mark ends his story this way:

both previous & current heads of SEC have been clear Bitcoin is a commodity, Gensler said “bitcoin alone”

crypto has been taking demand from bitcoin, as VC’s promote “the next bitcoin” but once that is done, it all flows back to BTC

You can read more about the news of Bitcoin being recognized as a commodity at this link. However, some lawyers dispute the exclusivity of Bitcoin as a commodity, here is an example of such a claim:

🚨 Seeing a lot of tweets misrepresenting what Gensler said today

While I’d love regulatory clarity, he didn’t say bitcoin is the only commodity

He said bitcoin is the only crypto he is prepared to publicly label a commodity

— Hailey Lennon (@HaileyLennonBTC) June 27, 2022

BTW for expecting a bull market

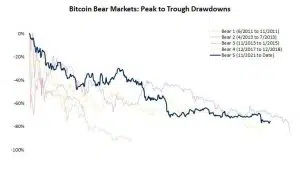

For those who think the current crypto winter is “just a manifestation of Bitcoin cyclicity,” confident of an inevitable bull market ahead, we suggest looking at a chart based on time-based analytics.

The depth and duration of the current bearish trend (in blue) in the cryptocurrency market compared to previous crypto winters. As you can see, another 2-3 weeks will provide Bitcoin with a new record for the length of the decline phase in its history.

Are you sure this crypto winter is just “another business cycle” that definitely won’t last forever? Mark Moss with his theory makes you think hard about the future of crypto (or of altcoins at least).

How can I make money on this?

If you read our three tips from The Wolf of Wall Street in addition to the above, you will find all the practical answers on how to behave within the theory from Mark Moss. Beware of speculative altcoins, invest in Bitcoin and get ready for the long run. It doesn’t guarantee anything, but at the very least it’s the safest strategy at the moment.