After the collapse of FTX, it’s now time to go with stablecoins and decentralized exchanges (DEX). After investors and users lost confidence in centralized exchanges and various tokens, stablecoins and DEX came to the fore. USD Coin (USDC) and Tether (USDT) have almost always been the most popular among stable cryptocurrencies. However, increased crypto freezes have made BUSD (or Binance USD) even stronger.

It is a USD stablecoin developed by Binance in cooperation with Paxos.

Binance’s stablecoin is now the 5th largest digital currency and the 3rd among all stablecoins. What’s next for BUSD?

Dawn of BUSD

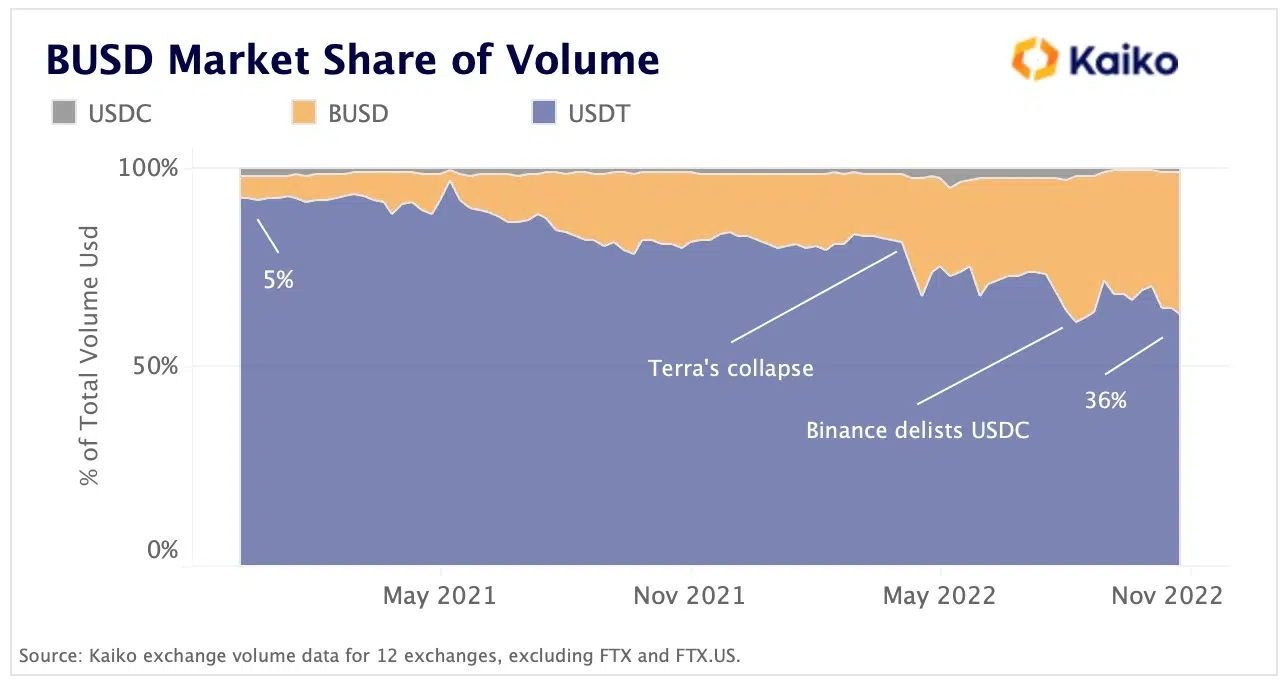

Stablecoin’s market share has grown steadily over the past two years, according to Kaiko Research. And while it was 5% at the beginning of 2021, it reached 36% last week. BUSD was one of the few that benefited from both the Terra crash in May and the FTX fall in November.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Thus, the BUSD share on the stablecoin market is approaching a new historical maximum. The market capitalization of BUSD increased to a record high of $23 billion in mid-November (although it fell slightly thereafter to $22.3 billion).

The USDT remains in first place so far, but its share in the CEX (Сentralized Exchanges) market has fallen from 92% to 64%. USDC’s market share on CEX has dropped to 0.9%, although it trades mostly on DEX, and trading volumes on Uniswap v3 are nearly five times higher than on CEX.

The use of Binance’s stablecoin increased dramatically after Binance canceled the commission on BTC trading pairs in July and delisted all USDC pairs in September.

Stablecoin supply changes over the past 8 months:$USDT -14.6B 📉$USDC -8.7B 📉$BUSD +5.1B 📈 pic.twitter.com/it0dZqGsWR

— Delphi Digital (@Delphi_Digital) November 18, 2022

A friendly reminder

Binance announced that it will remove seven isolated margin trading pairs of Bitcoin (BTC), Tether stablecoin (USDT), and Binance dollar (BUSD) starting December 2. Therefore, traders should have time to close their positions to avoid problems.

The following pairs will be affected:

BEAM/USDT, BTCST/BUSD, CVC/BTC, CVC/USDT, MITH/USDT, PERL/USDT and REP/USDT.

Binance is also launching a new batch of Cloud Mining products for BTC mining. Beginning Nov 29, users can subscribe to Cloud Mining products to purchase hash rates and begin accumulating mining rewards in their Funding Wallets.

How can I make money on this?

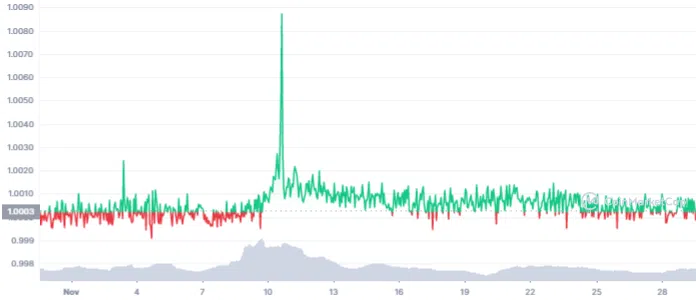

The price of BUSD is almost unchanging, $1 (it’s a stablecoin!).

And it has many uses. For example, BUSD can be used for transactions and payments. With Binance USD, users can transfer their digital dollars at a very low price on the blockchain. Or receive interest on their deposited tokens, use them as collateral, store them in a wallet, etc.

The strengthening of Binance continues on all fronts: the launch of new projects and the introduction of Proof of Reserve (when the company showed exactly what funds it has). All this makes investors trust the company more than not.

However, the crypto market is extremely volatile and one should not focus only on one token or one exchange. At any moment an unexpected 180-degree turn can happen.