UK-listed mining major Argo Blockchain has suspended trading in its stocks on NASDAQ before issuing a press release. The company’s management has remained silent so far, specifying only that some explanatory document will be made public in the very next few days. Many experts that are observing the situation believe that the company will declare bankruptcy.

So what’s the problem?

Argo Blockchain stock has been trading below $1 on NASDAQ for 30 days, violating exchange rules. On December 16, the company was already warned of a possible delisting in connection with this.

Argo Blockchain decided to voluntarily stop trading its stocks on NASDAQ, promising to give an explanation to investors in the coming days. For its part, the London Stock Exchange has also suspended trading in Argo Blockchain stocks, likely awaiting the company’s bankruptcy filing.

Argo has been trying to raise about $35 million in financing over the past few months to stay afloat amid a lack of liquidity. But last month, the company said a planned $27 million stock deal had fallen through and warned investors that it might have negative cash flow.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Meanwhile, according to Compass Mining director Will Foxley, Argo Blockchain indeed plans to file for bankruptcy. The director of a rival mining company regretted the large number of promising startups that have fallen victim to the crypto winter and wished all the remaining ones to weather the market storm successfully.

UPDATE: Argo Blockchain announced its deal with Galaxy Digital to sell Helios for approximately $65 million. So far the bankruptcy has been postponed.

💥Galaxy Digital spends $100 million to help Argo Blockchain escape bankruptcy

Bitcoin miner Argo Blockchain has decided to sell its Helios mining operation to Galaxy Digital for $ 65 million to help the company avoid the risk of bank.#Coin #Gamefi #ArgoBlockchain #GalaxyDigital pic.twitter.com/Eqg1jtD5Ge— Muhammad Aqib (@muhaqib490) December 28, 2022

What does this mean for the industry?

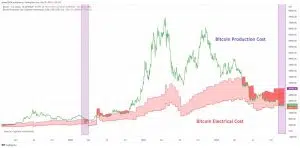

What’s happening fully corroborates our earlier analysis (source 1, source 2), where we stated that a BTC price below $20k will lead to a lot of bankruptcies of mining firms. This is significantly worsened by the energy crisis, in which the price of electricity has increased, leaving no chance for many mining companies.

So far, the Bitcoin Production Cost indicator is steadily in the negative zone, which produces a survival marathon in which only modern and most efficient mining companies will survive.

Therefore, bankruptcies of mining companies during the crypto winter have already become the norm, and if the price of Bitcoin does not change more and more companies from this market sector will go bankrupt.

Due to increasing #energy costs, #bitcoin #miners in the #northern regions of #Norway and #Sweden have shut down their #operations for the #winter season.#cryptomining #mining #bitcoinminers #europe #winter #inflation #ukrainianwar https://t.co/d4iwTjl0wG

— Unlock Blockchain (@unlockbc) December 27, 2022

How can I make money on this?

Generally speaking, making money in the conditions of crypto winter and the falling market is always difficult. More precisely, it is not even difficult but rather dangerous, as it involves a lot of risks.

But knowing the bleeding problems of mining companies, you can try to short their stocks. Several companies are in a similar difficult financial situation and publicly seek external funding: Core Scientific, Iris Energy, Blockstream, and others.

The lower the Bitcoin price falls, the more difficult the situation of all the named companies is, and the bolder you can bet on their fall.